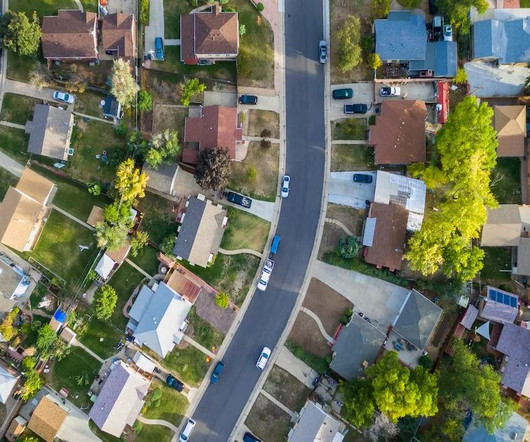

Pending home sales rise again as buyers capitalize on more inventory

Housing Wire

DECEMBER 30, 2024

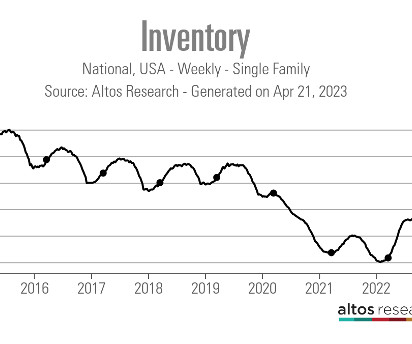

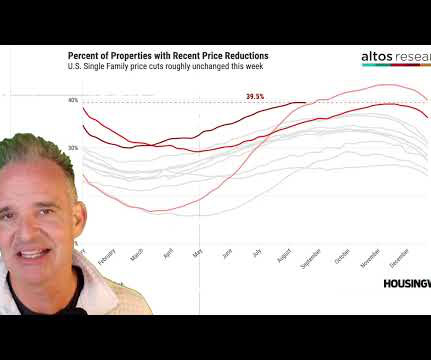

is the highest level for the PHSI since February 2023, according to NAR. “Despite higher mortgage rates in November and persistent affordability challengers, buyers took advantage of more inventory as pending home sales reached the highest level in nearly two years. compared to November 2023. month over month and 6.9%

Let's personalize your content