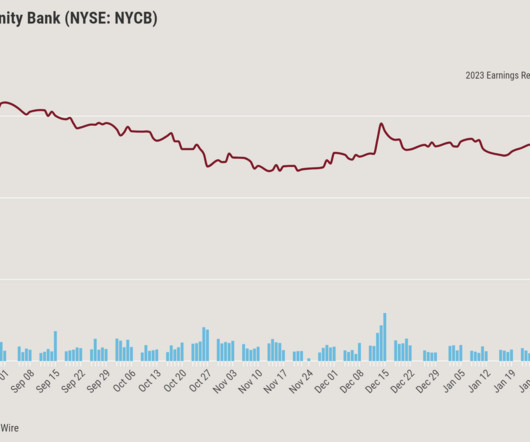

DataDigest: Office debt is stressing banks. That matters for mortgages.

Housing Wire

FEBRUARY 14, 2024

1, the company had lost 45% of its market value. Remote and hybrid work have dampened the prospects — and therefore valuations — of office towers across the country, causing tenants to miss rent payments and banks to write-down the asset values of the collateral tied to the loans they’ve made.

Let's personalize your content