Opinion: Do loan officers need more tech than they have now?

Housing Wire

JUNE 17, 2022

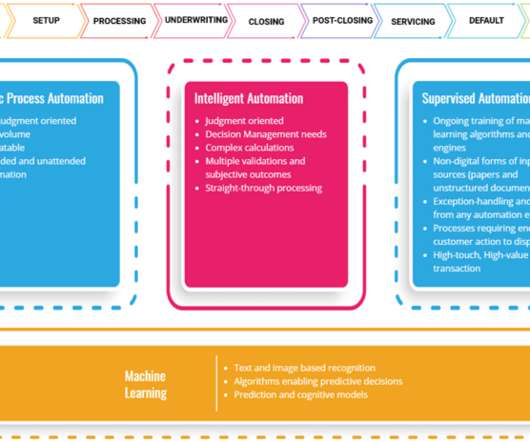

Do loan officers need more technology than they currently have? Will new technology change anything? Most loan officers do not believe they need more tech than they have now. Most loan officers do not believe they need more tech than they have now. They do not need more technology.

Let's personalize your content