Building resilience: Acra Lending’s blueprint for Non-QM lending success

Housing Wire

JULY 10, 2024

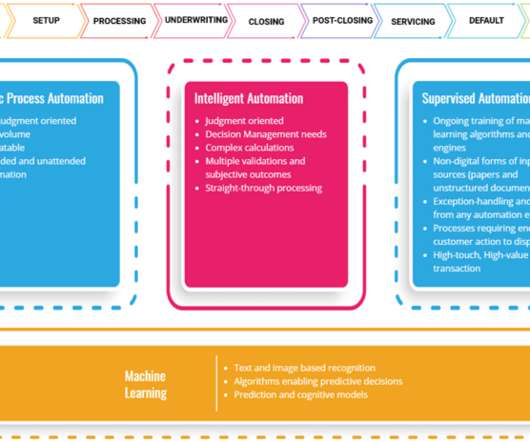

The complexities of Non-QM lending demand a strategic approach that combines innovation, efficiency, and resilience. Acra Lending has positioned itself at the forefront of this sector by investing in its workforce, optimizing processes, leveraging cutting-edge technology, and building a robust infrastructure. Craig Timmins.:

Let's personalize your content