Reevaluating your origination tools? Here’s where to start

Housing Wire

AUGUST 30, 2022

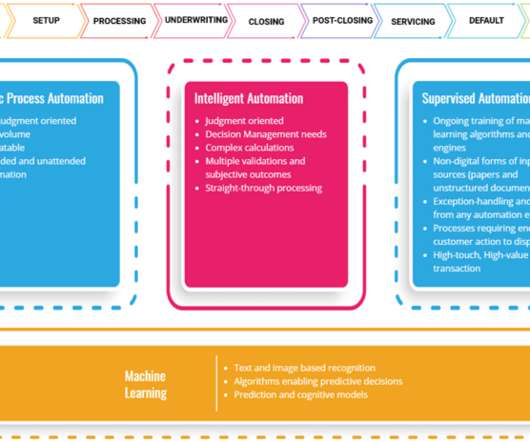

With the recent downturn in volume of new originations, many lenders are using this time to take inventory of the available tools geared toward risk mitigation and workflow optimization. This has led many lenders to feel overwhelmed by options and lack understanding of how, when and where to best implement new technology.

Let's personalize your content