Investor purchases are sinking with the housing market at large

Housing Wire

DECEMBER 20, 2024

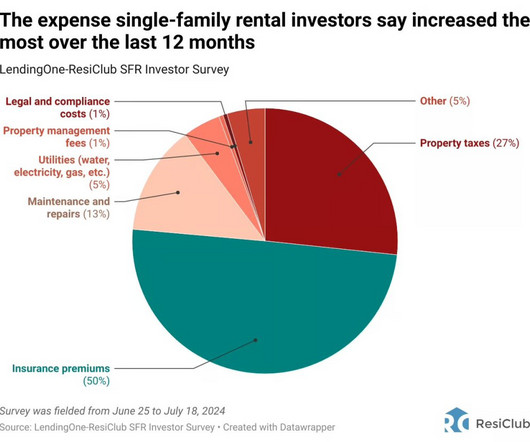

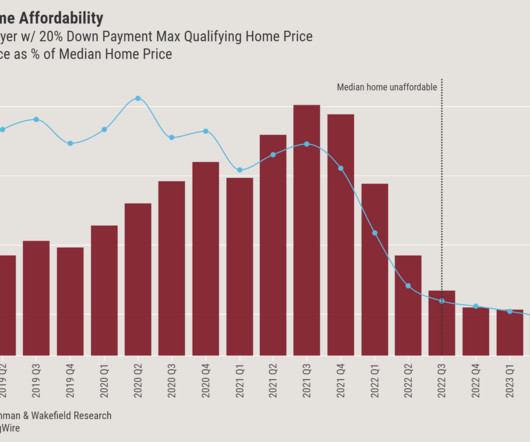

Higher prices, higher mortgage rates and limited inventory are making for a slow market among buyers and sellers alike. Real estate investors tend to be more insulated from these dynamics, particularly from mortgage rates, as they are more likely to buy properties with cash. compared to September 2023.

Let's personalize your content