Double whammy: Florida condo market grapples with rising insurance costs, milestone inspections

Housing Wire

JULY 24, 2024

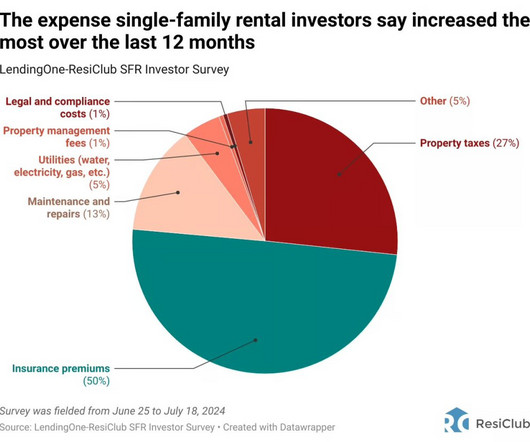

While there is no doubt that the Florida housing market has slowed since the height of the post-pandemic homebuying boom, the state’s condominium market has been especially hard hit, according to local agents. “It Altos considers anything above 30 to be indicative of a seller’s market. Insurance is still a major hurdle for many.

Let's personalize your content