Real estate investors have a ‘cautiously optimistic’ outlook: survey

Housing Wire

AUGUST 7, 2024

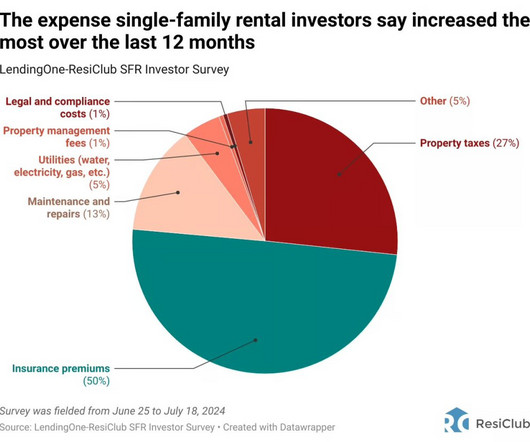

Single-family rental (SFR) investors are worried about the rising cost of home insurance, but the majority expect to buy more properties in the next year as mortgage rates cool and home-price growth subsides. That’s the conclusion from a survey of 235 single-family landlords in late June and early July.

Let's personalize your content