Luxury Home Values Snapshot

Appraisal Buzz

AUGUST 5, 2024

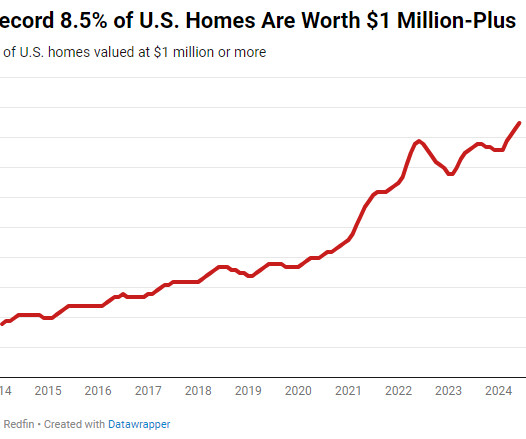

A new analysis from Zillow has found that luxury home value growth has now outpaced appreciation on typical homes for five consecutive months. The typical luxury home—defined by Zillow as the most valuable 5% of homes in a given region—is worth about $1,620,000. Luxury home values across the U.S.

Let's personalize your content