Property Taxes: Increases, Payments, and Where They’re Surging Most

Appraisal Buzz

OCTOBER 28, 2024

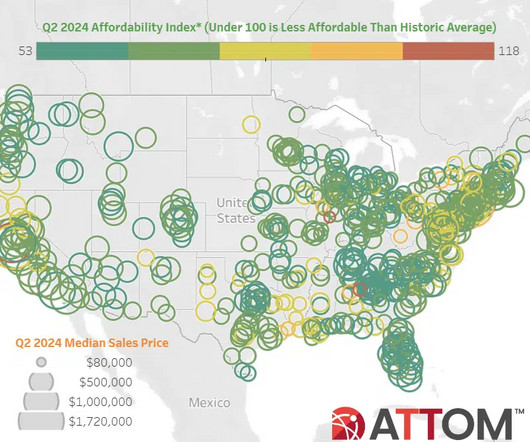

metro areas in Florida have seen the highest increases in property tax bills since the pandemic began, making it more difficult to afford a home in the Sunshine State, according to recent Redfin research. to $228 since 2019), according to a Redfin analysis of property taxes for single-family homes among the 50 most populous U.S.

Let's personalize your content