Government Agencies Release Mortgage Origination Data

Appraisal Buzz

JULY 1, 2024

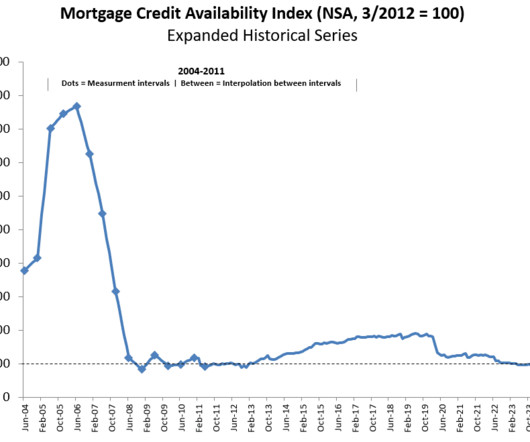

The post Government Agencies Release Mortgage Origination Data first appeared on The MortgagePoint. The post Government Agencies Release Mortgage Origination Data appeared first on Appraisal Buzz. The Dodd-Frank Act mandated that CFPB monitor the primary mortgage market, partly through the survey data.

Let's personalize your content