Amid legal uncertainty, MLSs explore cooperative compensation workarounds

Housing Wire

NOVEMBER 8, 2023

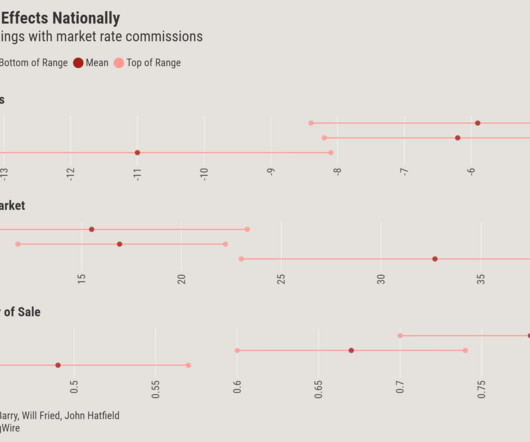

Though these policies have been put in place to avoid future antitrust lawsuits, legal experts who spoke to HousingWire said they might not be enough. But the policy may still present a legal issue, as it requires listing agents to make an offer compensation, even if that offer of compensation is in fact nothing ($0), law professors said.

Let's personalize your content