Is your property tax assessment too high?

San Jose Real Estate

JUNE 3, 2023

Is your property tax assessment too high? Appealing may be an option if the value is truly incorrect.

San Jose Real Estate

JUNE 3, 2023

Is your property tax assessment too high? Appealing may be an option if the value is truly incorrect.

Housing Wire

JUNE 9, 2023

Home prices aren’t crashing, despite what the housing bubble boys are saying. In fact, home prices have firmed up higher recently. The housing bubble boys are a crew that from 2012 to 2019 screamed housing crash every year. They went all in during COVID-19 in 2020, doubled down in 2021 as the forbearance crash bros but really bet the farm on a massive home-price crash in 2023 after the most significant home sales crash ever in 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sacramento Appraisal Blog

JUNE 5, 2023

Pickleball is all the rage, and today I want to talk about how the growth of the sport is becoming much more noticeable in real estate listings. I also have an interview with a friend who built a pickleball court in his backyard. For the record, I actually don’t play (yet), but a friend is […] The post That place where pickleball and real estate meet first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Real Estate News

JUNE 3, 2023

It's not uncommon for agents and brokers to work alongside spouses, siblings and other family members — see how they make it work + 4 tips for success.

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

Cleveland Appraisal Blog

JUNE 9, 2023

Hello! I hope you’re having a great summer! I am behind on my blogging for June. To get caught up, I have some returning guest bloggers who wrote some articles that I think you might enjoy. This week, I welcome back Ashley Rodriguez. In this article, she shares some pest control tips and tricks. I hope you find them useful! Photo by Pixabay on Pexels.com Pests continue to be a major concern for homeowners and business owners alike.

Property Appraisal Zone brings together the best content for appraisal professionals from the widest variety of industry thought leaders.

The Appraiser Coach

JUNE 6, 2023

Let’s talk about the velocity of money. This isn’t velocity in the sense of the physics term – we’re not looking at how fast a 50 dollar bill can fly through the air if you wad it up into a ball or make it into a paper airplane, no matter how fascinating that experiment may be. On the most basic level, the velocity of money is how quickly it changes hands.

Real Estate News

JUNE 8, 2023

The 30-year fixed-rate mortgage averaged 6.71% this week, the first drop in nearly a month.

Eyes on Housing

JUNE 9, 2023

Obtaining lots to build on remains a challenge for many of NAHB’s builders, although the shortages are not quite as widespread as they were in 2021. Responding to special questions on the May 2023 survey for the NAHB/Wells Fargo Housing Market Index, 42 percent of single-family builders characterized the supply of lots simply as low, and another 25 percent said.

Housing Wire

JUNE 8, 2023

It’s been a brutal 15-month period for the housing market since the Federal Reserve began escalating its benchmark interest rate in March 2022 to combat rising inflation. Since then, the Fed has bumped rates 10 times, effectively putting the brakes on what had been a hot housing market. As the June 13-14 meeting of the central bank’s Federal Open Market Committee (FOMC) approaches, the housing industry remains prepared for yet another jolt of rate shock.

Speaker: Dylan Secrest

Construction projects are high-stakes operations where even minor inefficiencies can lead to costly delays, safety concerns, and budget overruns. Managing risk in construction has always been a challenge, but as projects grow in complexity, traditional methods no longer cut it. Enter Digital Transformation - a game changer approach that replaces inefficiency with AI-powered analytics, real-time monitoring, and automated workflows to proactively manage risk.

The Appraiser Coach

JUNE 6, 2023

Let’s talk about the velocity of money. This isn’t velocity in the sense of the physics term – we’re not looking at how fast a 50 dollar bill can fly.

Real Estate News

JUNE 8, 2023

Home equity dipped last quarter for the first time in a decade, but big gains in recent years have kept most homeowners squarely in the black.

Eyes on Housing

JUNE 9, 2023

Consumer credit outstanding grew at a seasonal adjusted annual rate of 5.7% in April 2023 per the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 13.1% and 3.2%, respectively (SAAR). Total consumer credit outstanding stands at $4.8 trillion (not seasonally adjusted), with $1.2 trillion in revolving debt and $3.6 trillion in non-revolving debt (NSA).

Housing Wire

JUNE 4, 2023

Last week we saw a noticeable slowdown in housing inventory growth that I hope has more to do with a holiday week than a trend. Mortgage rates fell last week after the debt ceiling issues were resolved, but the damage from higher rates took its toll on purchase application data again. Here’s a quick rundown of the last week: Active inventory grew 3,180 weekly , and new listing data fell week to week and is still trending at an all-time low in 2023.

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Inman

JUNE 9, 2023

With the right products, your new luxury home can become a smart, convenient and energy-efficient living space, smart home expert Brandon Doyle writes.

Real Estate News

JUNE 6, 2023

Gene Millman, the leader of Colorado's largest MLS, believes MLSs "have a bad habit of forming silos" — but by working together, they can be stronger.

Eyes on Housing

JUNE 5, 2023

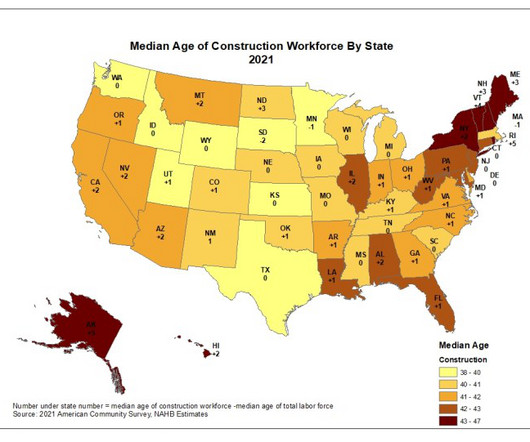

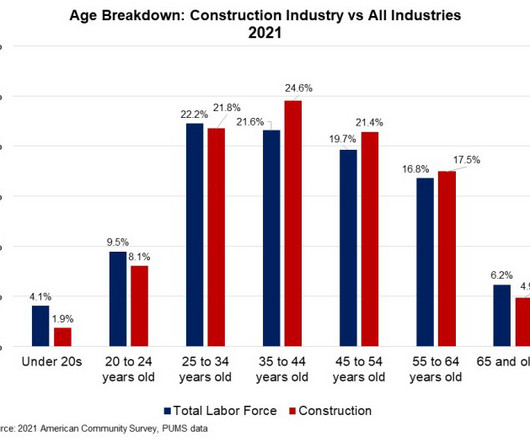

NAHB analysis of the most recent 2021 American Community Survey (ACS) data reveals that the median age of construction workers is 42, one year older than a typical worker in the national labor force. Attracting skilled labor is still the primary long-term goal for construction, even though a slowing housing market has eased some pressure on current tight labor market.

Housing Wire

JUNE 8, 2023

It is no secret that housing inventory is low. As of June 2, there were 433,104 single family homes on the market nationwide, according to data from Altos Research. And while this situation is certainly far from ideal, according to a report published Thursday by the National Association of Realtors and Realtor.com , even with the existing level of homes available for sale, the housing affordability and inventory shortage issues wouldn’t be so severe if there were enough homes for buyers at all i

Inman

JUNE 8, 2023

Troubled mortgage lender had touted Better Real Estate as a crucial component of its plans to build out an integrated end-to-end technology platform.

Real Estate News

JUNE 6, 2023

Black Knight reports that recent borrowers had higher credit scores and larger down payments, suggesting that lenders have tightened their standards.

Eyes on Housing

JUNE 8, 2023

Solid nominal wage gains (unadjusted for inflation) combined with lower mortgage rates and home prices helped to boost housing affordability in the first quarter of 2023, but ongoing building material supply chain issues and expected cooling of wage growth signal ongoing concerns for affordability conditions in the year ahead. According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), 45.6% of.

Housing Wire

JUNE 6, 2023

All 12 Federal Reserve districts have seen issues with a lack of housing inventory , which is largely due to existing homeowners holding back on listing their homes after previously locking in low mortgage rates. Demand from the buyer side has remained steady or increased, however, and new home builders have responded to inventory shortages by increasing speculative inventory production, according to the Federal Reserve Beige Book, released Wednesday.

Inman

JUNE 6, 2023

High property taxes in Texas have in the past canceled out some of the state's affordability advantages. But political leaders are looking for ways to reduce homeowners' tax burden.

Real Estate News

JUNE 9, 2023

Leading economist Dr. Paul Bishop and respected broker J. Philip Faranda were honored by the National Association of Real Estate Editors at their annual event.

Eyes on Housing

JUNE 7, 2023

The latest labor force statistics from the 2021 American Community Survey show that the construction industry continues to struggle to attract younger workers. While workers under the age of 25 comprised 13.6% of the US labor force, their share in the construction industry reached only 10.0% in 2021. Meanwhile, the share of older construction workers ages 55+ increased from less.

Housing Wire

JUNE 5, 2023

The affordability challenges homebuyers are facing are becoming more deeply entrenched, according to Black Knight ‘s most recent monthly mortgage monitor report. “In a sense, the gridlocked housing market has been feeding on itself,” Andy Walden , VP of enterprise research strategy at Black Knight, said. Tightening credit availability, elevated rates, inventory shortages and strengthening home prices are adding to affordability challenges, the report notes.

Inman

JUNE 5, 2023

Ahead of her appearance at Inman Connect Las Vegas, the CEO of Laurie Finkelstein Reader Real Estate shares why absorbing information and attending events is more crucial than ever in 2023.

Real Estate News

JUNE 9, 2023

Two of the state's top providers will no longer accept new applications, setting a grim precedent and adding another challenge for buyers.

George Dell

JUNE 7, 2023

USPAP requires that an appraisal is an opinion. EBV yields an analytic result. Editor’s Note: This is part IIIb of George Dell’s series on How Do I Move to EBV? Links to the earlier posts are here. USPAP (Uniform Standards of Professional Practice) is promulgated by the Appraisal Foundation, publisher of the irregularly issued rules, […] The post Appraisal Opinion vs Analytic Results?

Housing Wire

JUNE 9, 2023

Five federal agencies, including the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve , the National Credit Union Administration (NCUA) and the Office of the Comptroller of the Currency (OCC), are collectively proposing new interagency guidance on the reconsiderations of value (ROVs) for residential real estate transactions.

Inman

JUNE 7, 2023

Adina Azarian died Sunday when the small plane she was on crashed in Virginia. Investigators are now exploring the possibility that hypoxia impacted people on the Cessna 560 Citation V.

Real Estate News

JUNE 7, 2023

CoreLogic reported that national home price growth slowed to just 2% year over year in April, but gains (and losses) varied locally.

Let's personalize your content