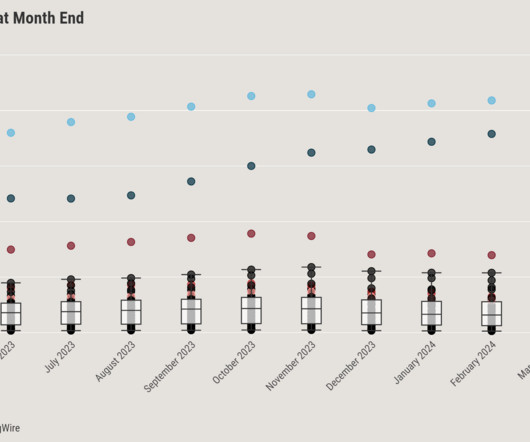

Unsold inventory is rising across the country

Housing Wire

MAY 28, 2024

It’s the end of May and unsold inventory on the market is increasing across the U.S. Every state in the country has more homes on the market now than a year ago and, in many places, new construction is being completed and added to inventory, so it’s not just resale inventory that’s growing. There are more homes on the market now than anytime since August 2020.

Let's personalize your content