The homebuilders’ 2025 supply and demand problem

Housing Wire

DECEMBER 23, 2024

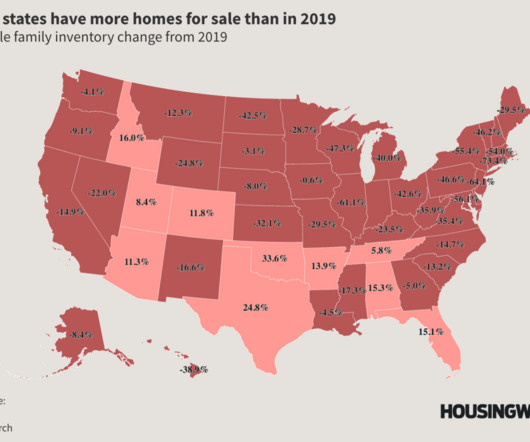

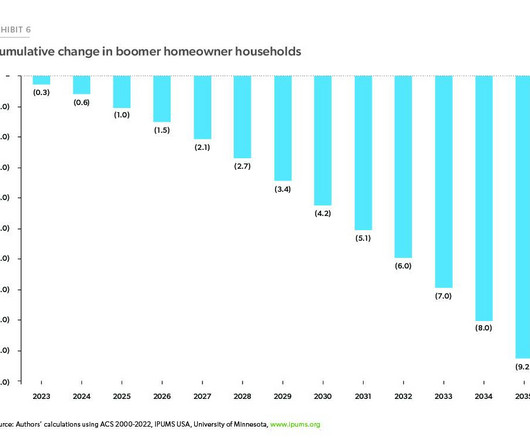

New home sales grew over last month in the latest Census report , but homebuilders are now facing a supply issue their inventory is building up. This is the reason why housing starts are at recession levels today. Monthly new home sales have been stagnant for the past two years. When mortgage rates decline, sales improve, but it becomes more challenging for builders and buyers when rates rise.

Let's personalize your content