Will Investors With High Credit Scores Pay More Now? What The New Mortgage Rules Actually Mean

BiggerPockets

APRIL 25, 2023

New mortgage rules set by the FHFA sent the investing community into panic. But what do these new rules actually mean?

BiggerPockets

APRIL 25, 2023

New mortgage rules set by the FHFA sent the investing community into panic. But what do these new rules actually mean?

Housing Wire

APRIL 23, 2023

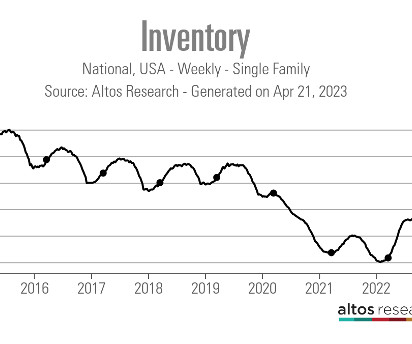

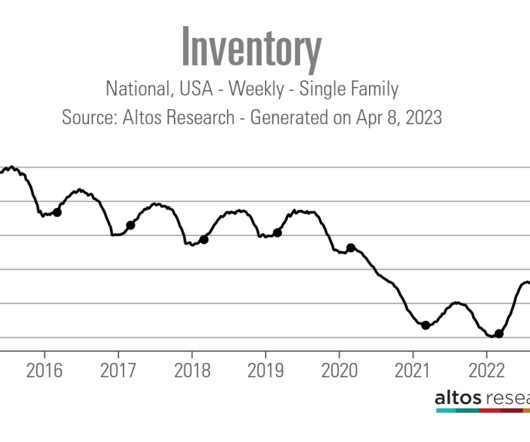

Can we now say that the housing market ‘s spring selling season is finally underway? Since 2020, the seasonal bottom for housing inventory has arrived several months later than normal, making it more complicated to track housing inventory data. Still, we have some promising signs that we might have finally hit the inventory bottom for 2023. We didn’t see too much volatility in mortgage rates last week, but purchase apps declined in reaction to rates rising two weeks ago.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sacramento Appraisal Blog

APRIL 25, 2023

Leaving California. That’s a buzzworthy topic. Let’s talk about migration today. I have lots of visuals and a few resources to share in case you’re in a different state and looking for data. I’d love to hear your take in the comments. UPCOMING (PUBLIC) SPEAKING GIGS: 5/4/23 Housing Market Q&A 12-2pm 5/10/23 Empire Home Loans event TBA […] The post Leaving California.

Cleveland Appraisal Blog

APRIL 11, 2023

With the massive amount of technology available to anyone who can access the internet, you might wonder why bother getting a real property appraisal? With a few quick online searches, in most areas, you can find the parcel number, legal description, and even some potentially comparable sales. Isn’t that all that appraisers do? Slap a few sales in a report, and make a few guesstimate adjustments to come up with their opinion of a property’s value?

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

Real Estate News

APRIL 13, 2023

The outcome of the Moehrl suit could affect countless buyer agents. Might Zillow and other portals become an Uber-style marketplace for those agents?

Property Appraisal Zone brings together the best content for appraisal professionals from the widest variety of industry thought leaders.

Eyes on Housing

APRIL 27, 2023

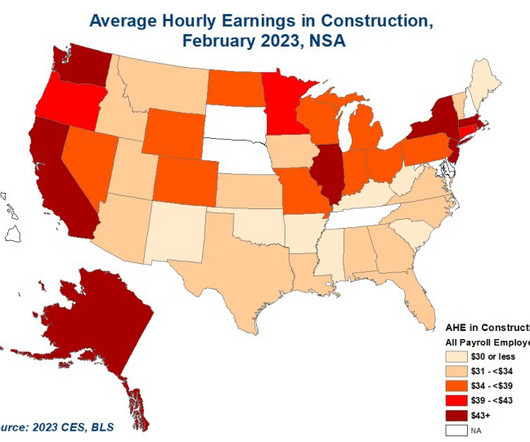

Despite a housing market slowdown but reflecting persistent long-term labor challenges, wages in construction continue to rise, often outpacing and exceeding typical earnings in other industries. According to the latest Current Employment Statistics (CES) report from the Bureau of Labor Statistics (BLS), average hourly earnings (AHE) in construction vary greatly across 43 states that reported these data.

Housing Wire

APRIL 7, 2023

Given Friday’s job report , those who have been concerned with entrenched 1970s inflation — which would lead to double-digit mortgage rates — can put their disco shoes back in the closet. I have tried to explain that the 1970s inflation isn’t a reality , and Friday’s report should ease the fear that wage growth is spiraling out of control.

Sacramento Appraisal Blog

APRIL 5, 2023

The market is hot again. Sort of. We’ve been seeing a spring seasonal market for a few months, but we seemed to hit an inflection point locally a few weeks ago, and it’s getting REALLY competitive out there. Let’s talk about it. This is a longer post, so scroll by topic or digest slowly. UPCOMING […] The post The housing market is hot again (sort of) first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Cleveland Appraisal Blog

APRIL 26, 2023

Hello friends! With a shortage of housing inventory persisting, some are resorting to building their own home. But to do so, you need land. This week, I welcome back guest blogger, Ashley Rodriguez with bins4less , who wrote this article for the Cleveland Appraisal Blog. I hope you enjoy it! Buying land can be a complicated and sometimes tiring process for an individual to take on all by themselves.

Speaker: Dylan Secrest

Construction projects are high-stakes operations where even minor inefficiencies can lead to costly delays, safety concerns, and budget overruns. Managing risk in construction has always been a challenge, but as projects grow in complexity, traditional methods no longer cut it. Enter Digital Transformation - a game changer approach that replaces inefficiency with AI-powered analytics, real-time monitoring, and automated workflows to proactively manage risk.

Real Estate News

APRIL 25, 2023

Several of the top brokerages in T3 Sixty's Mega 1000 list were founded after 2000, including top-ranking Compass.

George Dell

APRIL 26, 2023

Current efforts in the regulation of appraisal quality and fairness are fettered by obsolete appraisal methods. Traditional appraisal methods were designed to tackle sparse, subjective, non-electronic data. These vintage practices enable bias, hinder diversity initiatives, and conceal risk quantification. We have written about the “Five Frictions” hindering improvement in regulated appraisal valuation.

The Appraiser Coach

APRIL 25, 2023

If you’ve ever read about the 5 Love Languages by Gary Chapman, you know that, for must of us, there are particular things that make each of us feel loved.

Housing Wire

APRIL 9, 2023

The housing market welcomed the news of lower mortgage rates last week after four reports showed that the labor market isn’t as tight as it seems and that the fear of 1970s-entrenched inflation was a lousy narrative. The 10-year yield finally broke below a critical technical level it had difficulty breaking for many months and we had a very small increase in inventory.

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Sacramento Appraisal Blog

APRIL 11, 2023

The housing market feels like a reality TV show. New sensational drama every week, juicy gossip, strong opinions, emotions, and big cliffhangers that might affect the future. Anyway, today I want to dig into Dream For All and some of the bigger themes right now (monthly recap stats at the bottom). Scroll by topic or […] The post Real estate dreams & getting ridiculous under $500K first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Cleveland Appraisal Blog

APRIL 19, 2023

Hello friends! I hope you’re doing well! Are you staging a home, or just looking to freshen up your place? This week I welcome back guest blogger Ashley Rodriguez, with bins4less , who wrote this article for me to share with you. She shares some things to think about regarding traditional wall art. I hope you enjoy this article! Decorating your living room with traditional wall art is a great way to infuse some personality and character into your home.

Real Estate News

APRIL 20, 2023

DR Horton, seen as a “heat check” for the housing industry, blew past analyst expectations with its Q2 profits and offered an encouraging take on spring.

George Dell

APRIL 12, 2023

Appraiser credibility continues to decay over time. Even during the great runup in prices, and now the spotty, often rapid rundown in prices – residential appraisers mostly turned a blind eye to the need for this critical “time adjustment.” Non-residential appraisers have yet to see the coming value shifts. Shamefully, a time adjustment, (or market […] The post No Time for Time Adjustment?

The Appraiser Coach

APRIL 18, 2023

Today I want to share a principle that I am very passionate about; this principle drives everything that I do! The principle is that people thrive when they love what.

Housing Wire

APRIL 16, 2023

The seasonal housing inventory bottom evaded us again last week as active listings fell and new listing inventory decreased. Purchase application data rose again, with more positive than negative data in 2023. Mortgage rates didn’t move much last week, but the 10-year yield rose even though inflation data was tamer than expected, and we had a weaker retail sales report number.

Sacramento Appraisal Blog

APRIL 19, 2023

The housing market has really started to heat up lately, and today I want to talk about how I’m thinking about prices right now. I also have some thoughts about checking the “declining” box. Scroll by topic or digest slowly. UPCOMING (PUBLIC) SPEAKING GIGS: 5/4/23 Housing Market Q&A 12-2pm 5/10/23 Empire Home Loans event TBA 5/18/23 SAFE […] The post Rising spring prices and appraisers checking the “declining” box first appeared on Sacramento Appraisal Blog | Real Est

Miller Samuel

APRIL 1, 2023

The Office of the New York State Comptroller released its analysis of Wall Street Bonuses for 2022 last week. The real estate industry used to go gaga over this report before the housing bubble. But now, with so many bonuses received as deferred compensation or in a non-cash format, the Manhattan housing market no longer sees an immediate surge in demand when bonuses are announced.

Real Estate News

APRIL 10, 2023

With inventory low and interest rates elevated, economists don’t expect to see activity pick up until later in the year.

George Dell

APRIL 5, 2023

Editor’s Note: This is Part 3 of Bruce Hahn’s series on Is the Definition of Market Value Outdated? In Part One and Part Two we asked why the current definition of market value has been around without change for so long? We focused on item 4 in the current definition of market value which says: […] The post Is the Definition of Market Value Outdated?

The Appraiser Coach

APRIL 11, 2023

When I was on my quest to learn what I call the “principles of prosperity,” there was one in particular that helped me progress by leaps and bounds when I.

Housing Wire

APRIL 20, 2023

We only have 2.6 months’ worth of housing inventory in the U.S. after coming off the single biggest home-sales crash year in history. That is where we are today in America. As expected, existing home sales fell from February to March since the previous month’s report was intense. We have a workable range for 2023 sales in the existing home sales market between 4 million and 4.6 million.

Eyes on Housing

APRIL 5, 2023

As described in a previous post, NAHB’s recently released its 2023 Priced-Out Estimates, show that 96.5 million households are not able to afford a median priced new home, and that an additional 140,436 households would be priced out if the price goes up by $1,000. This post focuses on the related U.S. housing affordability pyramid, showing how many households have.

Housing Wire

APRIL 7, 2023

Shrinking wholesale lender Homepoint is closing its mortgage origination business and will sell its origination-focused assets to competitor The Loan Store , the company announced on Friday. Michigan-based Homepoint is “winding down” its tenure as a direct participant in the mortgage origination business and becoming an investor in the market, as the company will hold an equity interest in The Loan Store.

Housing Wire

APRIL 30, 2023

The spring housing market music is playing, and purchase application data and active listing inventory rose together last week. The fear of not having an increase in inventory this spring should be put to rest. The other focus should be where mortgage rates go; only a little happened last week. Here’s a quick rundown of the last week: Active listing rose 8,260 week to week, down a bit from last week’s gain, but I’m not complaining — anything on the plus side is positive.

Housing Wire

APRIL 18, 2023

What is the best news for mortgage rates long-term? It’s getting more supply of apartments! The best way to fight inflation is always by adding more supply; if your goal is to destroy inflation by killing demand, that is only a temporary fix. Housing inflation post-2020 was one for the record books, not only because home prices accelerated in such a short time, but more importantly for the inflation data, rents took off, something that didn’t happen during the housing bubble years.

Housing Wire

APRIL 3, 2023

Last week was relatively calm for the housing market after the fiasco of the banking crisis. Housing demand grew and inventory levels fell again while mortgage rates rose. Here’s a quick rundown of the last week: The 10-year yield battle continues as bond yields rose early in the week only to close below 3.50% on Friday. Mortgage rates rose to 6.57%.

Housing Wire

APRIL 25, 2023

Why are the homebuilder stocks up so much? Don’t they know the new home sales apocalypse is here? You know, the one that says we have too much inventory and millions of vacant homes in the U.S.? According to this theory, we have more homes under construction than any time in history. The truth is, it’s not 2008 all over again. I understand the lure of the housing 2008 story.

Let's personalize your content