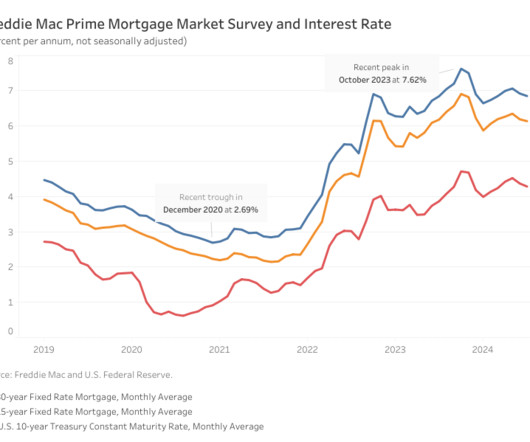

Mortgage rates plummet and everything has suddenly changed — for now

Housing Wire

AUGUST 2, 2024

Prospective borrowers with strong credit are locking in mortgages this week at the lowest rates in more than a year, loan officers and lending executives told HousingWire on Friday. A sample of more than a dozen industry professionals said they were quoting most borrowers in the high 5% to low 6% range on government loans and in the mid-6% range for conventional mortgages.

Let's personalize your content