FHFA conforming loan limits increase to $766,550 in 2024

Housing Wire

NOVEMBER 28, 2023

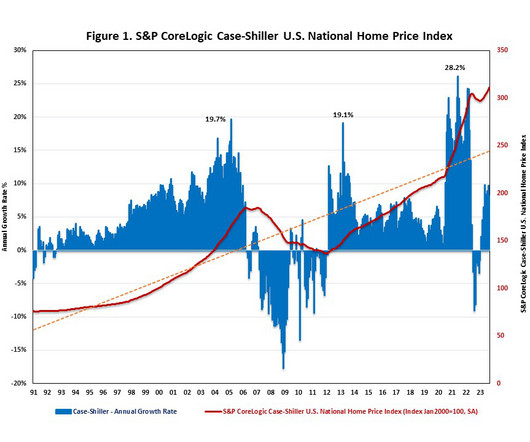

The baseline conforming loan limit for mortgages backed by Fannie Mae and Freddie Mac in 2024 will be $766,550, up 5.5% compared to the current limit of $726,200 , the Federal Housing Finance Agency (FHFA) announced Tuesday. Conforming loan limits are increasing at a slower pace, mirroring home prices, overall. That’s because the FHFA’s conforming loan limit increase is based on a formula related to home-price data in the third quarter of each year.

Let's personalize your content