Inflation and Fed day: A crucial moment for the housing market

Housing Wire

JUNE 12, 2024

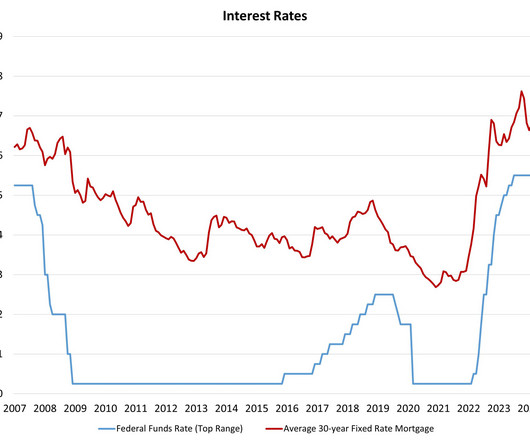

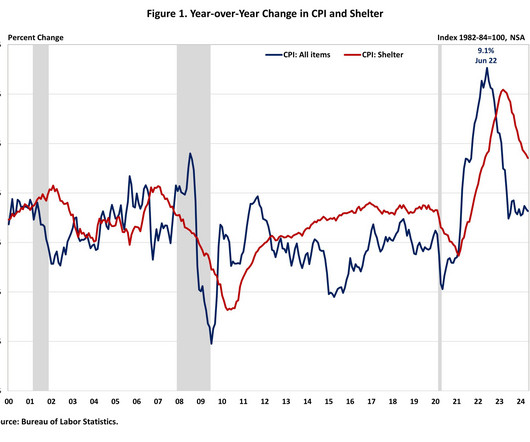

Today’s double event of the CPI inflation report and the Fed meeting gave us something that I have been waiting for: a hint from Fed Chairman Jay Powell that the labor market has softened. Today he acknowledged what I have been talking about for months: the Fed’s key data lines are at pre-COVID-19 levels today. Before the Fed held its press conference, we got a softer-than-anticipated CPI report, which sent the 10-year yield (and mortgage rates ) lower at first.

Let's personalize your content