2023 New home sales helped the economy avoid a recession

Housing Wire

JANUARY 25, 2024

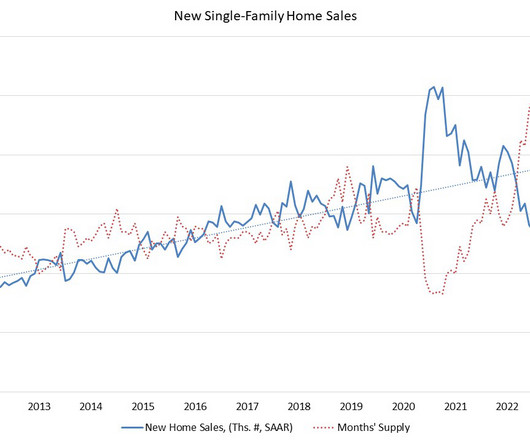

People say that housing leads the economy into a recession: this is true when new home sales and housing permits fall together. When that happens, the builders start laying off workers before the national economy goes into a recession. This is one reason I raised my fifth recession red flag for Housing on June 16, 2022 as I saw that higher mortgage rates would impact new home sales and housing permits.

Let's personalize your content