The Fed holds rates steady at final meeting of 2023

Housing Wire

DECEMBER 13, 2023

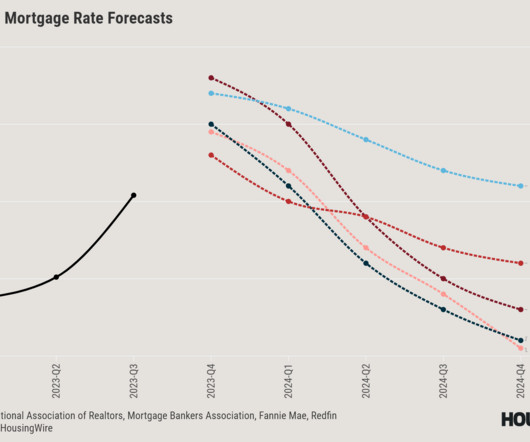

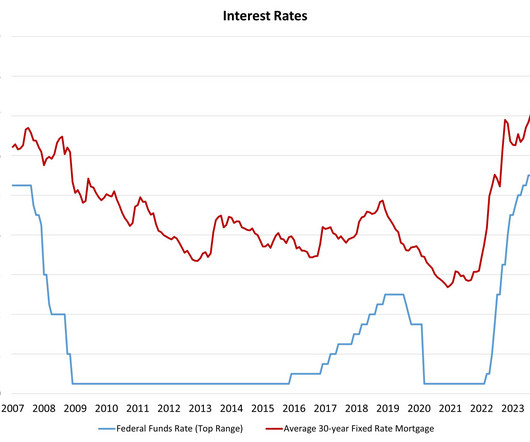

The Federal Open Markets Committee (FOMC) held its short-term policy interest rate steady at a range of 5.25% to 5.5% at its last meeting of the year on Wednesday. It was the fourth pause recorded in 2023. Investors will parse Jerome Powell’s press conference this afternoon for clues about when and why the central bank might change its policy stance next year.

Let's personalize your content