Consumer sentiment toward housing reaches its highest level in nearly two years

Housing Wire

FEBRUARY 7, 2024

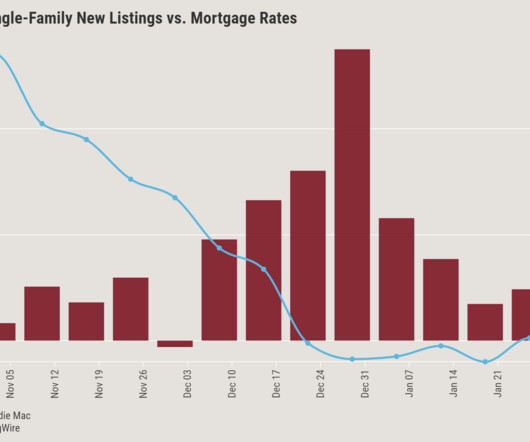

Consumer sentiment toward housing reached its highest level since March 2022, fueled by increased confidence in job security and a higher share of people who expect mortgage rates to decrease. Fannie Mae ’s home purchase sentiment index ( HPSI ) — which tracks the U.S. housing market and consumer confidence to sell or buy a home — rose 3.5 points in January to 70.7.

Let's personalize your content