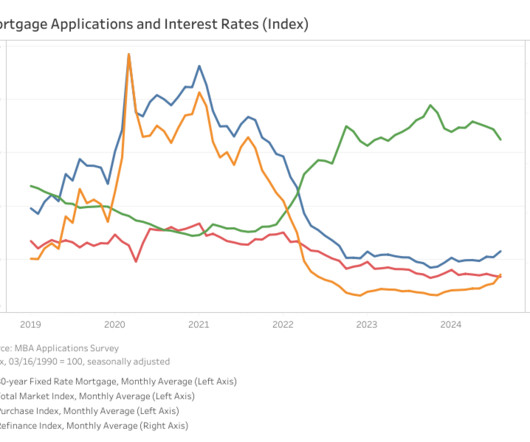

Mortgage rates falling to 5% would get a swath of buyers back in the market

Housing Wire

SEPTEMBER 5, 2024

Declining mortgage rates have yet to break the dam on the stalled housing market, but the sweet spot on rates that would get the market moving again is about 5%. That’s according to a new survey from Mphasis Digital Risk, which revealed that 42% of prospective buyers said a 5% rate would get them back in the market. An additional 27% said they’re targeting a 4% rate, while 20% say it’s 6%.

Let's personalize your content