Are 1970s inflation and mortgage rates possible?

Housing Wire

MARCH 12, 2024

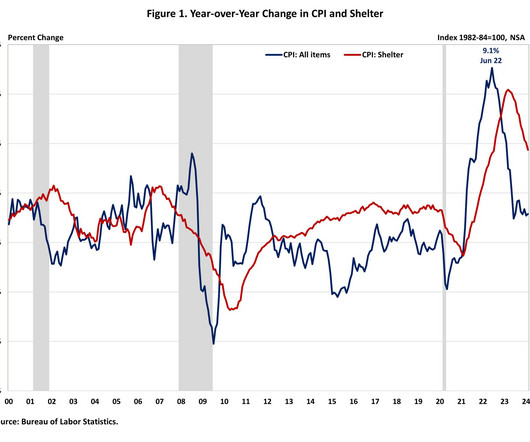

The CPI report came out Tuesday, and the headline number showed a 12-month inflation of 3.2%. The running average of CPI going back to 1914 has been 3.3%. So, what should we take away from this number, seeing that market participants are still worried about 1970s inflation and some don’t want to see any rate cuts this year? Fed presidents and others have cited the fear of 1970s-style entrenched inflation as a reason they hiked rates so fast and are being careful as they consider rate cuts.

Let's personalize your content