Real estate’s strong 2023 housing market finish: Altos

Housing Wire

JANUARY 2, 2024

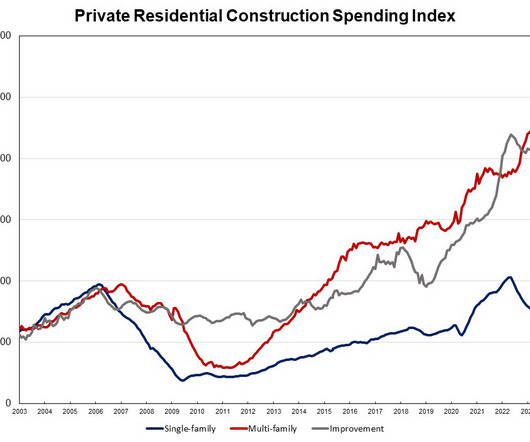

The last week of data for the year U.S. real estate market is in and it may surprise you, but pretty much all the signals for housing in 2024 are pointing for growth now. Inventory is slowly but steadily increasing over last year, which means slightly more options for buyers this spring. Sales rates are climbing. We have more homes going into contract each week now than we did a year ago — supply and demand are climbing together.

Let's personalize your content