Certainty Home Lending adds national business development leader

Housing Wire

MAY 22, 2024

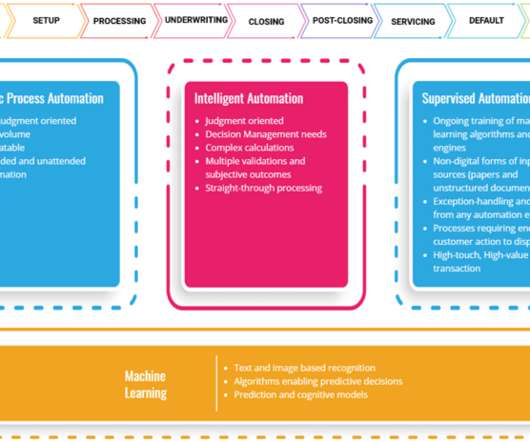

Dallas -based Certainty Home Lending , an affiliate of Guaranteed Rate , named Shadi Kamran as its new national business development executive. The technologically advanced mortgage platform empowers loan officers to serve both customers and business partners with ease and excellence.

Let's personalize your content