Loan officers made insane money in Q4 2020

Housing Wire

JANUARY 29, 2021

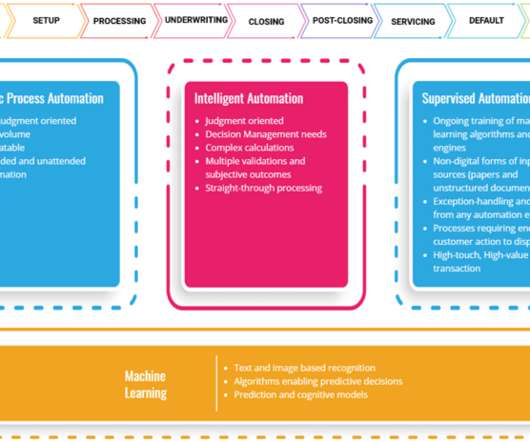

Over $4 trillion in originations made its way through the housing market last year, and new data from mortgage software firm LBA Ware revealed that by the end of 2020, loan officers played every last card in their deck to get those deals closed by New Years. Mortgage Tech Demo Day.

Let's personalize your content