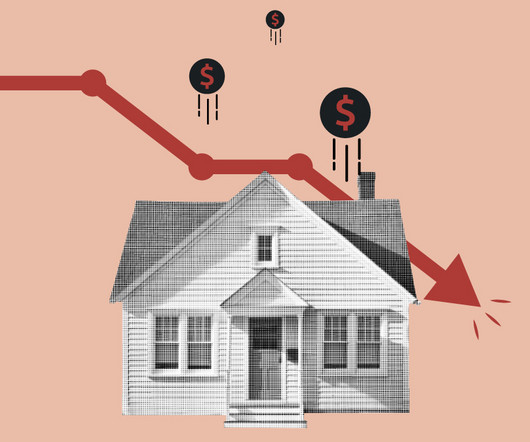

New listings surge as the spring buying season approaches

Housing Wire

MARCH 15, 2024

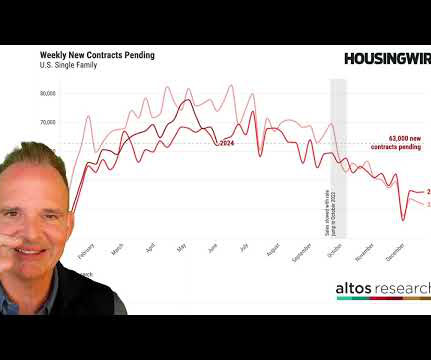

Mortgage demand has been on the rise for two weeks in a row. Inventory has been trending upward for the last two years despite persistently high mortgage rates, Mike Simonsen, president and founder of Altos Research , wrote on Monday. New listings rose 20% from January, and each of the 50 largest U.S.

Let's personalize your content