Will 2025 finally be a “normal” housing market?

Housing Wire

DECEMBER 9, 2024

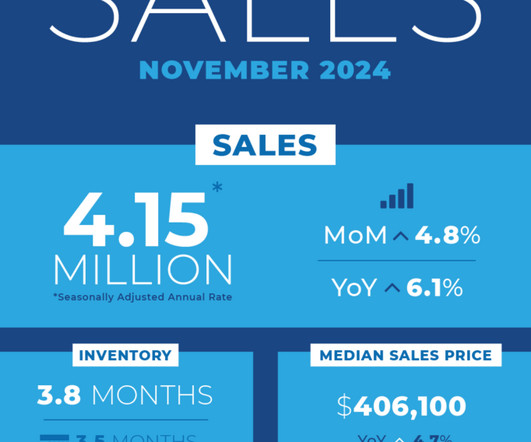

Weve now been in the post-pandemic housing market recession market as long as we were in the pandemic boom. Does the housing market start to get back to normal? Supply growth could also come from more sellers, such as investors or distressed borrowers unloading. Two and a half years. is $384,900 now.

Let's personalize your content