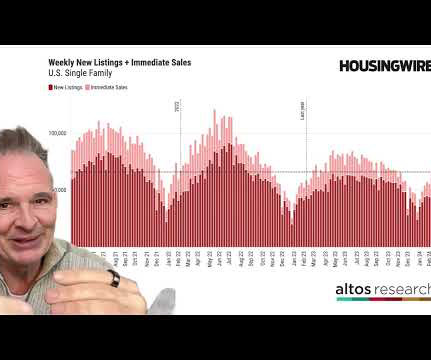

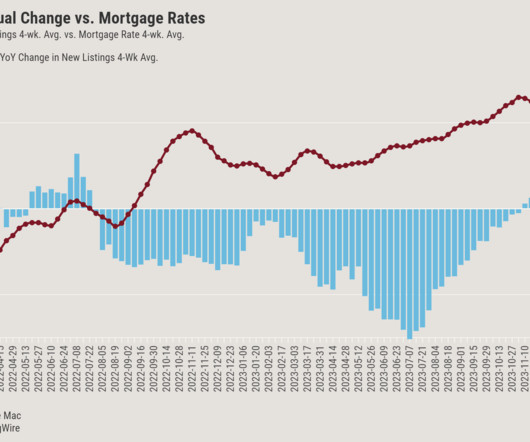

New listings have peaked for 2024: It’s the second-lowest year on record

Housing Wire

JULY 27, 2024

One of my critical forecasts for 2024 was the growth of new listings data and active inventory, even with higher mortgage rates. However, the new listings data has slightly disappointed me. New listings data I am pleased that we’ve seen new listings data grow year over year — it’s a big step forward.

Let's personalize your content