Simplifying the Digital Mortgage Payment Process

Appraisal Buzz

JUNE 13, 2024

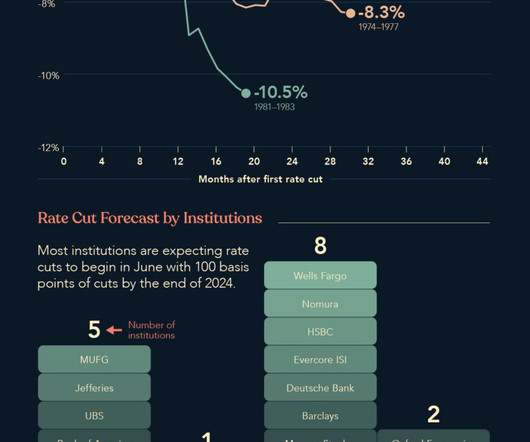

Mortgage delinquency rates in early 2024 are trending upward as a result of economic pressure bouncing back from unusually low levels of the past year. The trend of increasing mortgage delinquencies for all loan types can be traced back to the emergence from the pandemic economy in 2022. However, consumer preferences are evolving.

Let's personalize your content