Working with buyers in the nation’s hottest housing market

Housing Wire

APRIL 13, 2021

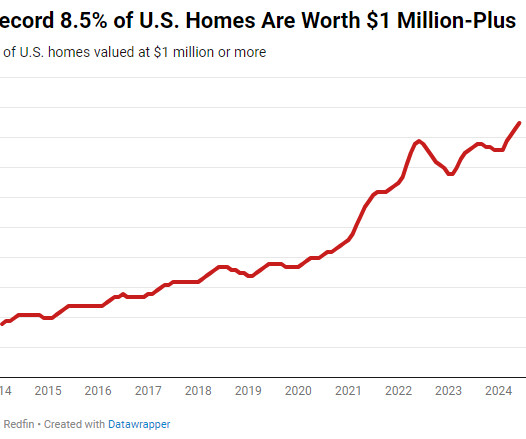

year-over-year increase in home values. Rapidly accelerating home prices come with a variety of challenges for lenders and real estate agents, including one of the biggest pain points right now — the appraisal gap. “If Garrett said aside from cash buyers, he also has clients who have money to offset any appraisal gap.

Let's personalize your content