As housing demand cools, don’t overlook foreign investors

Housing Wire

SEPTEMBER 25, 2024

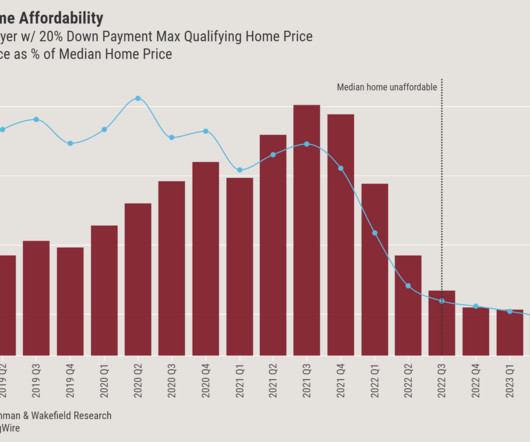

Current home price data shows that affordability remains one of the biggest challenges for buyers today, particularly when coupled with persistently high interest rates. Given what is indicated in the National Association of REALTORS report on international transactions, it may not be the buyer you expect.

Let's personalize your content