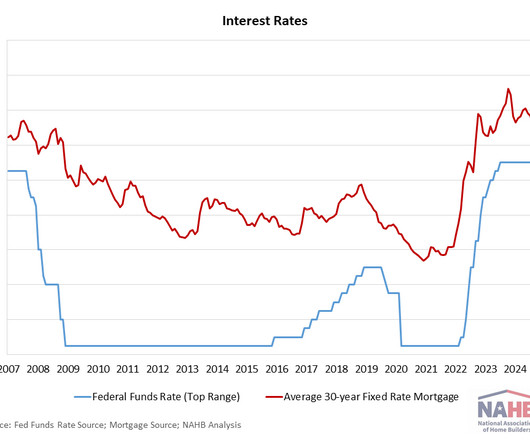

The Federal Reserve’s housing recession dilemma

Housing Wire

DECEMBER 18, 2024

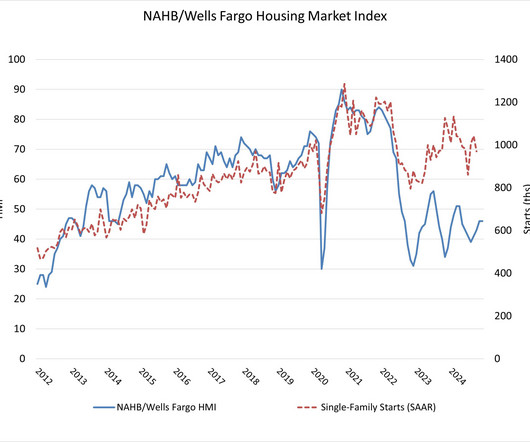

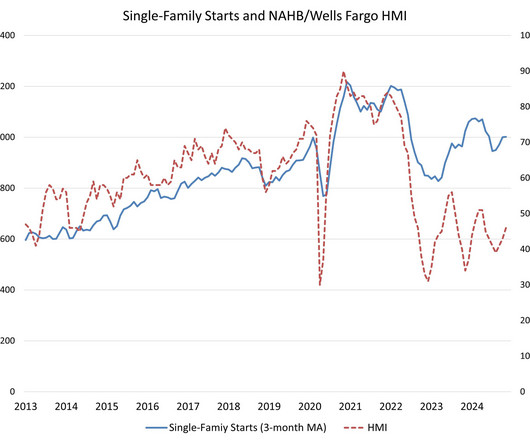

They say housing leads the economy in and out of a recession. Currently, housing starts are back at the levels seen during the COVID-19 recession in 2020. Interestingly, employment for residential construction workers typically one of the first areas to experience declines before a recession has not yet seen its usual downturn. Several factors have been keeping labor steady, such as working through a backlog of orders and long turnaround times to complete projects.

Let's personalize your content