The two big housing market trends to watch in 2025

Housing Wire

DECEMBER 30, 2024

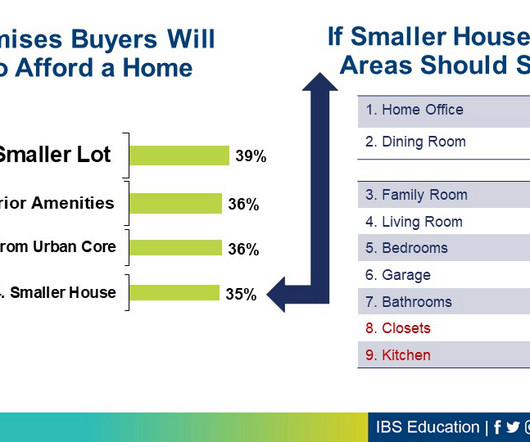

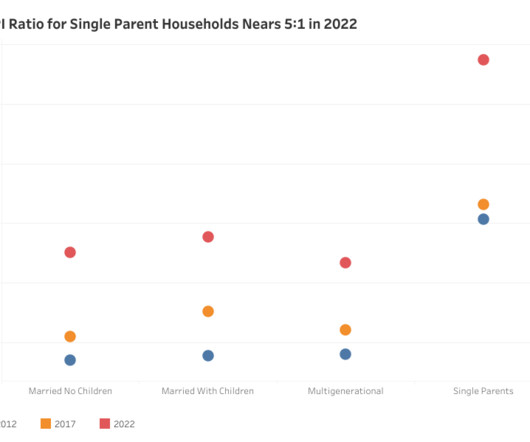

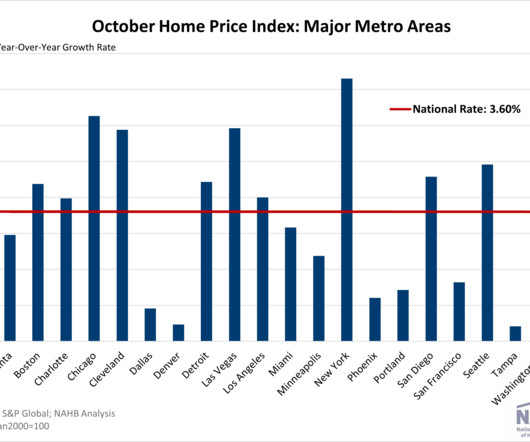

All the housing market data for 2024 is in, and its fair to say that the housing market surprised us again! However, there are two big trends that stand out as we launch into 2025 affordability and sellers in the market. The elephant in the room is affordability. Home prices finished 2024 up a few percent nationally and mortgage rates are at their highest level in seven months back over 7% as we head into January.

Let's personalize your content