Home Insurance Markets Stabilize as 2024 Comes to a Close

Appraisal Buzz

NOVEMBER 26, 2024

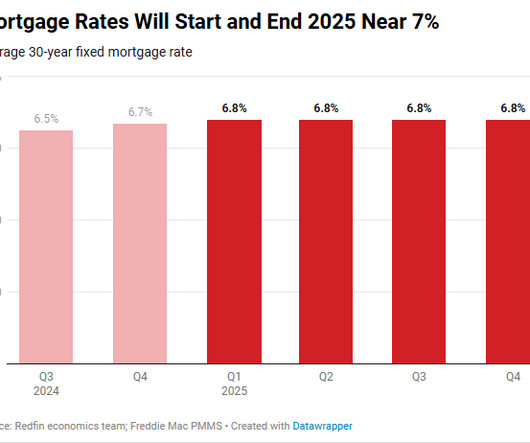

Matic announced that it has published its annual year-end trends and predictions report, which examines significant developments in the house insurance market and their effects on mortgage lenders and homeowners. Regulatory obstacles could still impede development, though. as opposed to 10.7% in the first half of the year.

Let's personalize your content