Housing Market Forecast: Unpredictable Mortgage Rates to Shake Up 2025

Appraisal Buzz

NOVEMBER 26, 2024

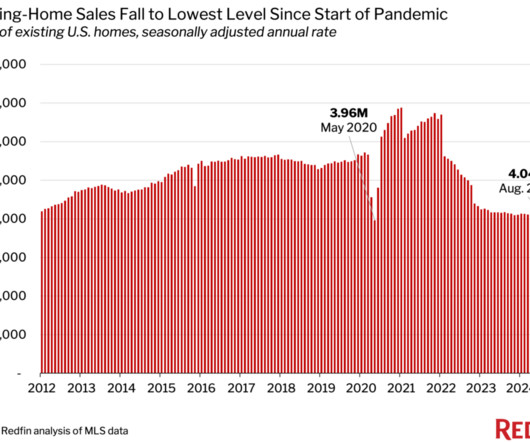

As 2025 draws near, mortgage rates are once again in the news. Zillow anticipates a more active housing market with more buyers obtaining the upper hand in 2025. As the market gradually recovers, 2025 should bring more sales and relatively moderate increases in property values. increase in property values in 2025.

Let's personalize your content