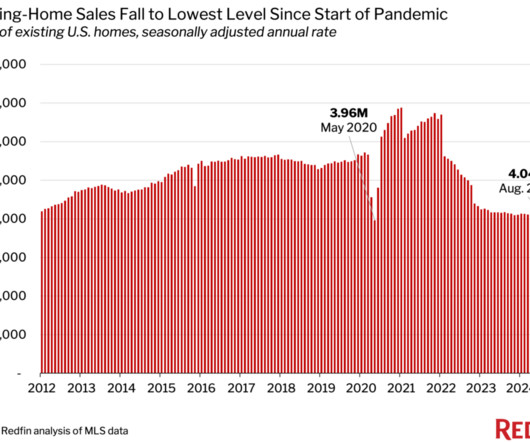

Pending home sales surged in December: NAR

Housing Wire

JANUARY 26, 2024

For comparison, the index is benchmarked at a reading of 100 based on 2001 contract activity. New home sales , another measure of contract signings, rose 8% in December on the back of declining mortgage rates. increase between 2024 and 2025 to a pace of 5.35 increase between 2024 and 2025 to a pace of 5.35 in November.

Let's personalize your content