Real estate investors purchased 16% of homes in Q3 2024

Housing Wire

NOVEMBER 22, 2024

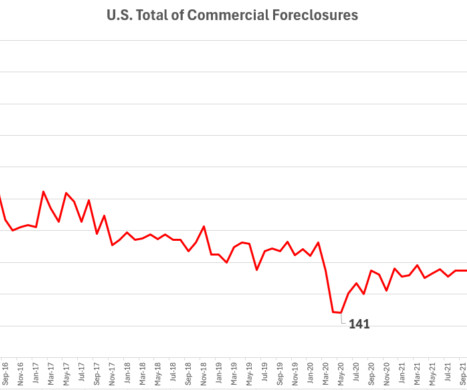

year over year in Q3 2024, representing a small change after four years of fluctuations. billion worth of properties in Q3 2024, up 3.4% of all homes sold in Q3 2024, down from 16.2% As the U.S. The Seattle-based brokerage found that real estate investor purchases dropped by 2.3% Investors purchased $38.8

Let's personalize your content