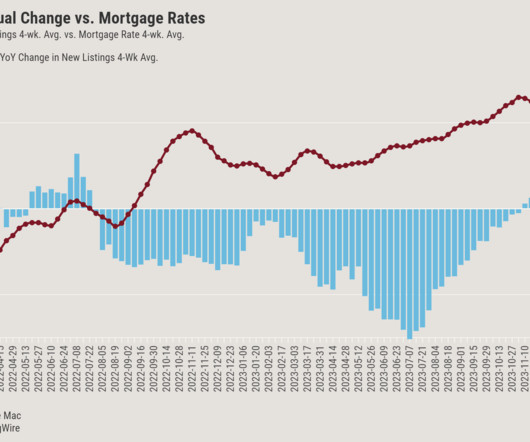

Higher mortgage rates keep the market subdued even as more sellers list their homes

Housing Wire

OCTOBER 22, 2024

Mortgage rates continue to rise, serving as a bucket of cold water for lenders and consumers that were warming to lower borrowing costs just a few months ago. According to HousingWire ‘s Mortgage Rates Center , the average 30-year conforming rate was 6.61% on Tuesday. in 2023, but starts for attached properties rose by 3.2%

Let's personalize your content