Surging home insurance premiums challenge mortgage industry, regulators

Housing Wire

JULY 25, 2024

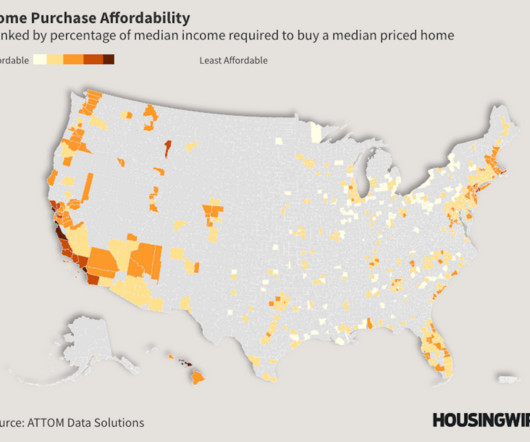

Home insurance premiums have risen by as much as $865 this year for homeowners who originally purchased their policies in 2021. In response, the mortgage industry and federal regulators are aiming to determine the best courses of action to mitigate the financial burdens on both homeowners and insurance carriers.

Let's personalize your content