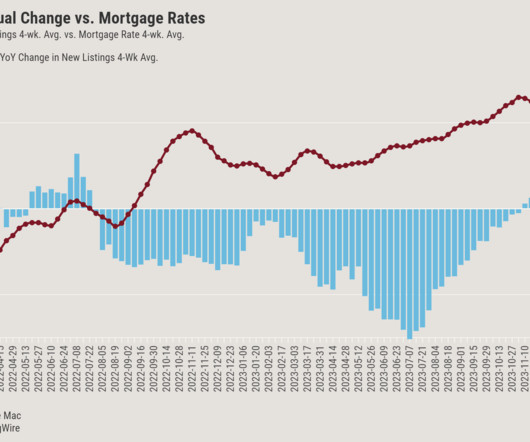

New mortgage data shows lean times for originators, tight wallets for buyers

Housing Wire

APRIL 10, 2024

Perhaps the most striking detail gleaned from a HousingWire analysis of millions of single-family purchase mortgages is how much more homebuyers had to pay in 2023 compared to 2022. Residential mortgage originators are responsible for filing data with the CFPB under the Home Mortgage Disclosure Act.

Let's personalize your content