Existing home sales data shows extent of housing inflation

Housing Wire

SEPTEMBER 22, 2022

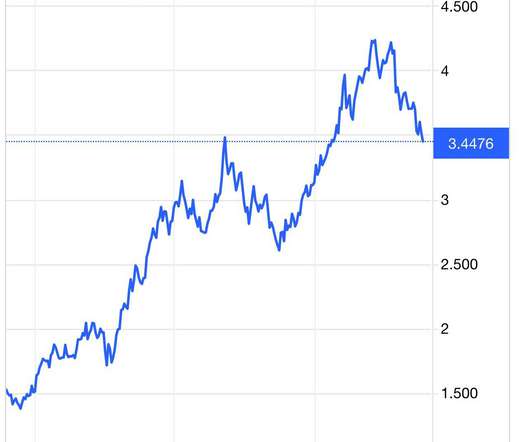

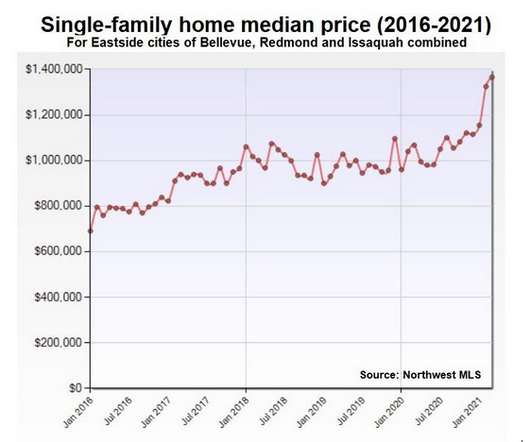

With the home-price growth we had in 2020 and 2021, my five-year price-growth model that I set for 2020-2024 of 23% was already smashed in just two years. Since the summer of 2020, I have talked about what could change the housing market, which was a 10-year yield above 1.94%, which means rates over 4%. million in August.”

Let's personalize your content