Labor market report is good news for mortgage rates

Housing Wire

MAY 3, 2024

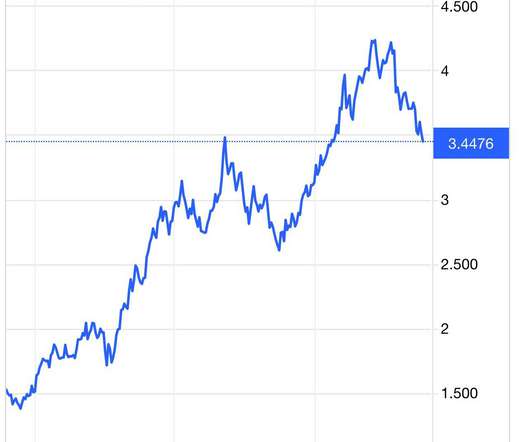

The labor market isn’t tight anymore and that will eventually be good news for mortgage rates. Let’s look at my labor economic model that started on April 7, 2020, and see where are we today. The current state of the labor market results from a series of events, with COVID-19 being a significant catalyst.

Let's personalize your content