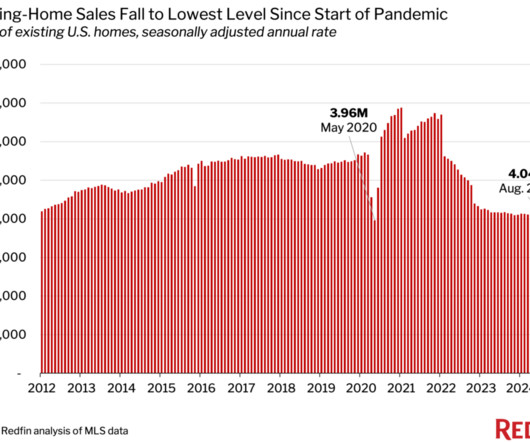

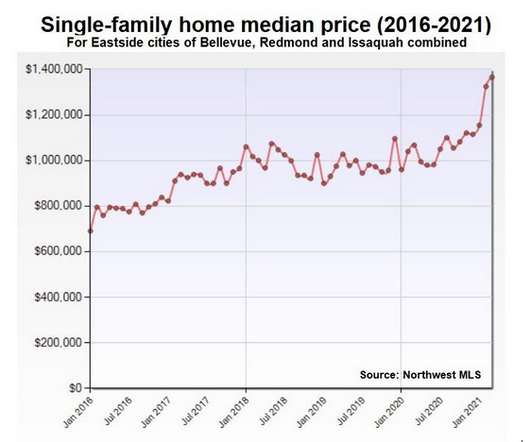

To avoid recession, the Fed needs a housing comeback

Housing Wire

AUGUST 16, 2024

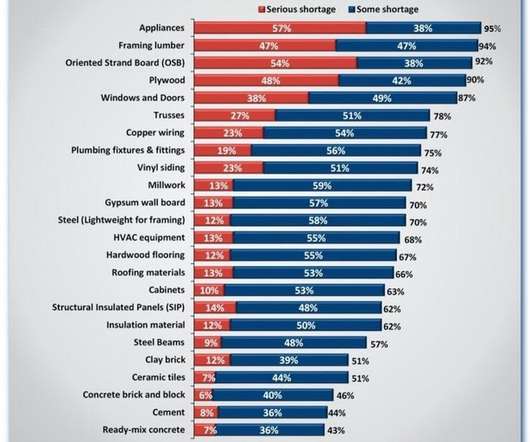

One key data line that is flagging a path to recession is the loss of residential construction workers. Today, housing starts activity is at the levels we saw during the brief pandemic-fueled recession of 2020. Let’s look at today’s residential construction report and see where we are. Why is this happening?

Let's personalize your content