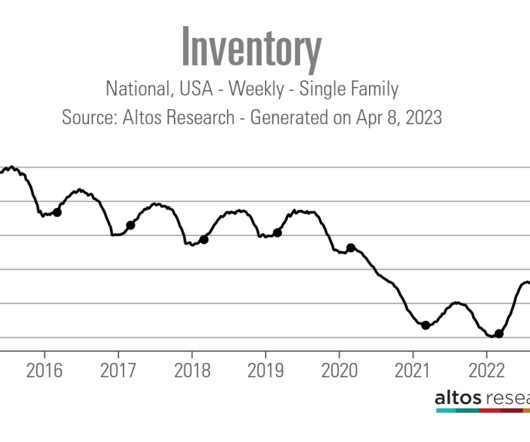

Eight states now have more unsold inventory than in 2019. Here’s why.

Housing Wire

AUGUST 29, 2024

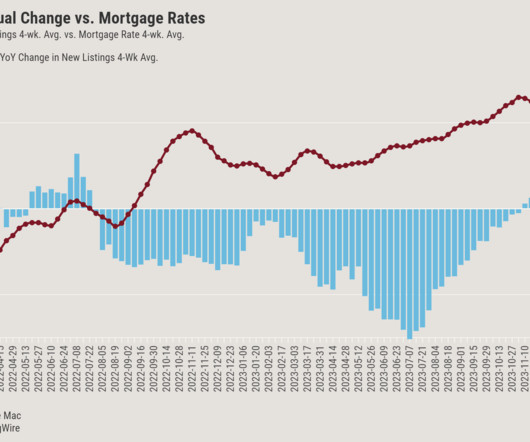

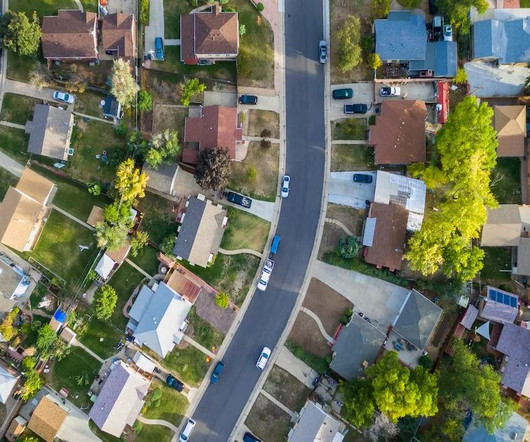

for two years, right along with rising mortgage rates. That means currently just over 700,000 single-family homes are unsold, with about 10% of those going into contract each week, and another 75,000 new listings. But still, there are about 300,000 fewer homes on the market now than in August of 2019. Why does it matter?

Let's personalize your content