Fidelity CEO says federal government’s title insurance proposals are ’misguided’

Housing Wire

MAY 14, 2024

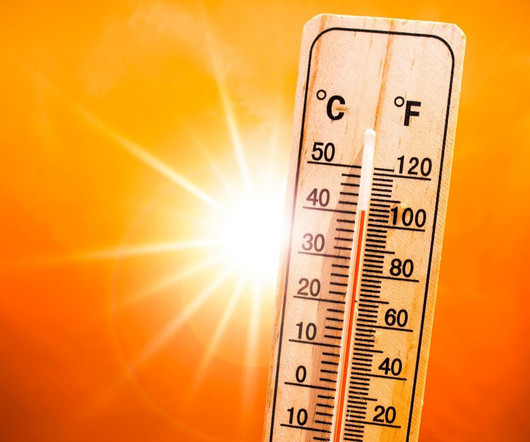

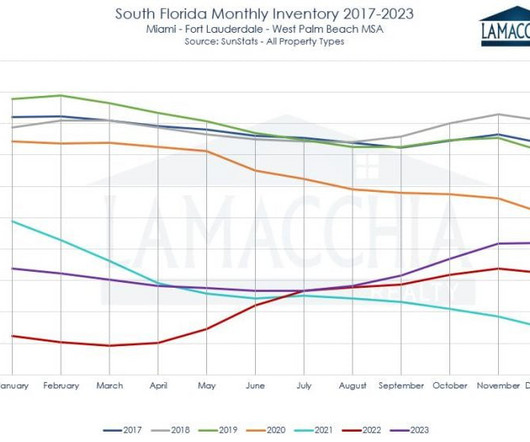

The firm attributed its stronger results to better performance from both its F&G segment and its title insurance segment. In April, purchase open orders per day were up 4% over last year, but higher mortgage rates may temper purchase volumes going forward. The firm’s title segment reported $1.7

Let's personalize your content