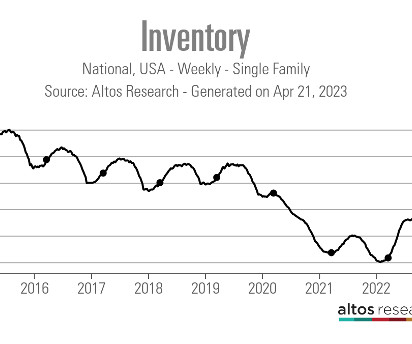

Is housing inventory growth really slowing down?

Housing Wire

AUGUST 10, 2022

One of the most important housing market stories in recent weeks has been the decline in new listings , which has slowed the growth rate of total inventory. Redfin : Realtor.com : Altos Research : Clearly, we are seeing a slowdown in new listings as the data has been negative now for months. What does this mean?

Let's personalize your content