Better mortgage spreads are capping rates in 2025

Housing Wire

FEBRUARY 8, 2025

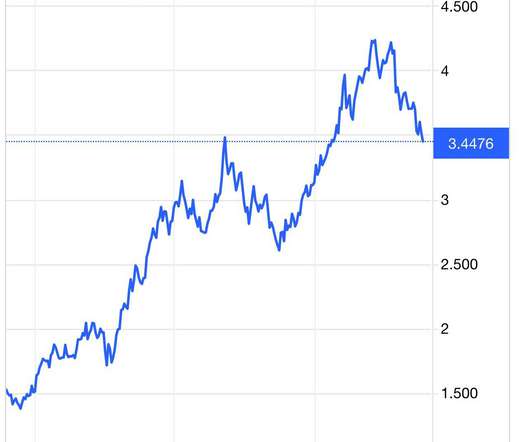

Another jobs week has come to an end, and amid the chaotic headlines about job numbers, tariffs , and the leadership of the Treasury , mortgage rates remained calm. Better mortgage spreads are limiting how high rates can rise in 2025. Mortgage spreads refer to the difference between the 10-year yield and the 30-year mortgage rate.

Let's personalize your content