Luxury home sales rise 41.5%, making biggest jump since 2013

Housing Wire

OCTOBER 13, 2020

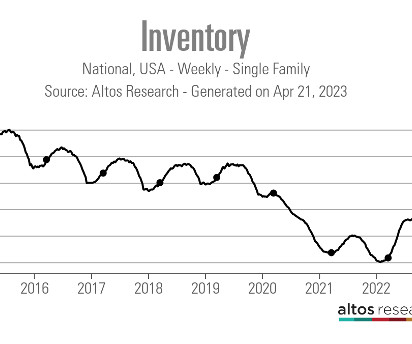

In the largest increase since 2013, luxury home sales rose 41.5% While sales in this segment of the housing market have skyrocketed, the sales of medium-priced homes went up only 3% and sales of affordable homes actually declined by 4.2%. Notably, the only market with increased inventory was luxury. year over year, Redfin said.

Let's personalize your content